Request a Dayshape demo

Get in touch and learn first-hand how Dayshape can help boost profitability, improve client service, and keep your teams happy.

Platform

Strategic resource management

Optimize margins. Grow revenue.

Plan reliably. Act confidently.

Inspire teams. Delight clients.

Enterprise scalability

Use Cases

How Dayshape helps firms

10 ways for resource managers to elevate their impact

Elevate your role, expand your influence, and drive impact across your firm.

Listen nowCustomer Success

Value at every stage

Company

More about Dayshape

Resources

Learn more

Resources

Featured resources

Resource Management Maturity

The complete blueprint to transform your resource management.

Learn moreThis article is a write-up of our Digital Accountancy Forum presentation.

It’s safe to say that accounting has been steadily evolving over the past few decades.

But the sudden and, for the most part, unexpected impact of Covid-19 has meant firms have had to make bigger technological leaps this year than usual. Now more than ever, there’s a demand for technology that lets accountants do what they do best under entirely new circumstances.

So, what can new technologies like automation do to help?

The switch to full-scale remote working during lockdown has had a huge impact on accounting. Suddenly, staff are communicating entirely online – affecting the ability of firms of all sizes to manage their most valuable assets: their people.

We can already see businesses around the world adapting to this new way of working beyond the pandemic. Facebook and Google have told employees that they can work from home all the way up until next summer. Twitter has gone a step beyond and is letting employees work from home forever. Slater and Gordon has given up its London office in the wake of the change, and in finance, JP Morgan is embracing Zoom calls indefinitely.

From a practitioner perspective, workers are rethinking the attractions of the office workspace post-Covid, and it’s easy to see why:

89% of accountancy and finance employers are experiencing a skills shortage, and this challenge certainly hasn’t gotten any easier this year.

When dealing with a remote workforce, how do you effectively mentor incoming cohorts? How do you keep staff motivated on those late-night jobs that require all hands on deck without the in-office camaraderie and free takeaway pizza? With WFH, those little perks can fall through the cracks, and retaining your talented people becomes an uphill battle.

On the upside for firms, alternative flexible options for talent may become more viable. You could think outside the box and start resourcing jobs using semi-retired partners, or part-time practitioners who have entrepreneurial ‘side gigs’. Now you’re working remotely and have become ‘geographically agnostic’, you can make use of practitioners with the right skills, regardless of location.

Everything we’ve mentioned so far means that the average engagement team in the future will look very different, and that’s before we even start to think about any additional risks.

A recent Deloitte survey found that 45% of responding businesses were using ‘alternative’ labour in the finance function, but that 54% either managed alternative workers inconsistently or had few or no processes for managing them. That, of course, just won’t fly for large accounting firms, so begs the question, ‘How can firms use technology to keep existing staff happy in their roles, as well as make the most of alternative labour sources?’

First things first, let’s talk about the different types of automation available, and how these tools are used in professional services.

| PSA Software | Professional Services Automation (PSA) software uses basic automation and logic to collate timesheets, send out invoices or populate your client relationship management (CRM) database. |

| Business Rules Engines | By making your logic-driven software more configurable, you can create business rules engines. For example, coding bank statement transactions, based on specific logic-based rules. |

| RPA | Robotic Process Automation (or RPA) connects up your software systems and uses a ‘digital workforce’ to automate the most monotonous, repetitive tasks – in a way where you’d traditionally have needed people to be the glue. |

| Optimization | Combinatorial optimization uses combinatorial techniques to solve optimization problems. For example, Dayshape uses optimization and artificial intelligence (AI) to solve resource planning issues and hurdles. |

| Machine Learning | Machine learning is a field of AI which allows your software to ‘learn’ and evolve its capabilities and accuracy, based on the data it processes. So, for example, the more bank transactions your AI system processes, the better it gets at picking the right cost code and automating this process efficiently. |

Automation in your accounting firm can take many different forms. The key to success is knowing which automation solution to use in which situation.

One type of automation isn’t necessarily better than the other – they each have strengths in different areas. It’s also worth bearing in mind that the business value derived from your specific automation solution doesn’t necessarily correlate to how technically complex it is behind the scenes. Sometimes the simplest thing can deliver an enormous benefit.

The Covid crisis has changed how people think about work and how they want to work. Firms are already changing how they think about resource management, realising that there’s no need to be limited geographically. That simple change adds up to a tremendous opportunity, but also introduces more complex ways of resourcing.

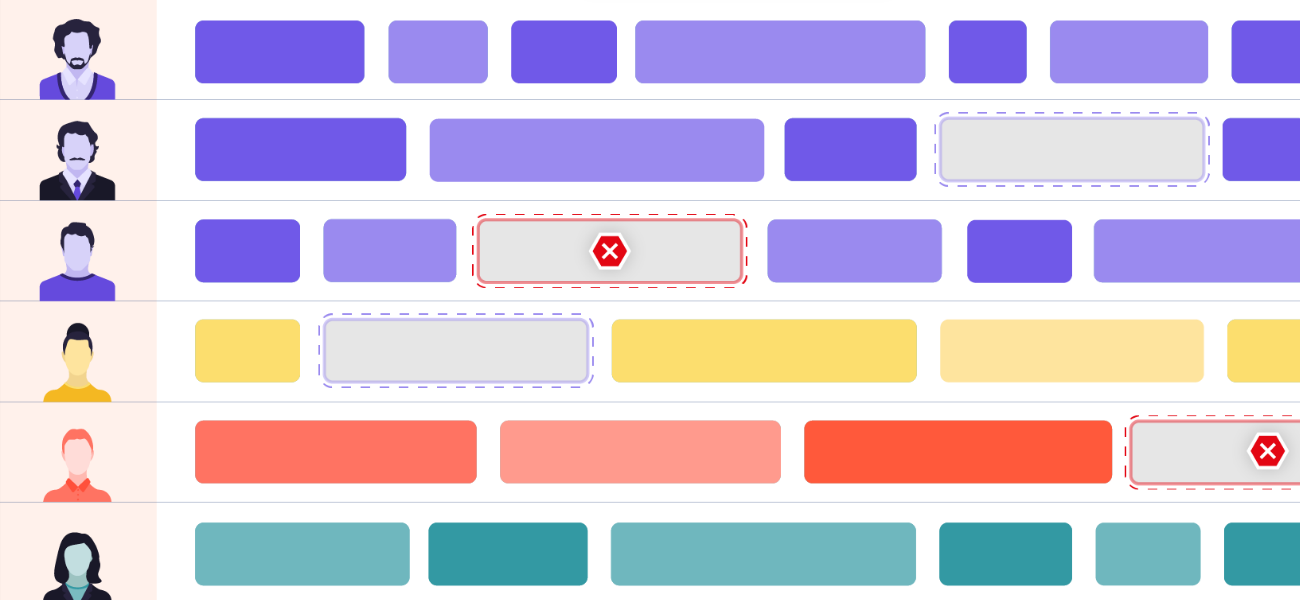

Let’s look at a hypothetical example: we’re in our post-Covid world and a client engagement is running behind schedule. You are the manager who needs to allocate a senior associate to help get things back on track. What do you do?

There’s a lot to consider. And whether you’re dealing with a single request or hundreds of requests, this complex task can soon become impossible to manage efficiently.

Automating that resourcing job, on the other hand, helps you out by considering:

The accounting industry was facing some fairly major regulatory issues well before Covid hit. The ring-fencing of Big Four audit practices, fines for audit misconduct and the dangers of mismanaging sensitive client data were all there before the pandemic.

But has Covid increased the issues faced by the average accountancy firm?

Post-Covid challenges now include:

But, if you can get automation to work its magic on the resourcing of the job, and the performance reporting of the engagement, it has the potential to stop the whole job blindly going off a cliff.

Running your firm during a crisis was never going to be easy, but the impact of Covid has changed everything. Staff now expect different things, firms have completely changed how they operate, client expectations may differ, and working patterns are more than likely going to change. Compile that with mounting regulatory pressures and new working from home risks that need to be factored into your longer-term business and people strategies. It’s no walk in the park.

But Covid-19 has presented an opportunity for accounting firms, and a chance to mitigate some of the compliance risks. There’s a great chance to work smarter by putting automation at the heart of your firm’s strategy, and by putting good technology at the heart of the practice.

Get the latest insights and updates delivered to your inbox weekly.

Explore our latest insights and strategies for success.

4 min read

4 min read

5 min read

Discover how AI can transform your resource management and enhance your project delivery.

Get in touch and learn first-hand how Dayshape can help boost profitability, improve client service, and keep your teams happy.